Source: C-SPAN: Pam Bondi, House Judiciary hearing, Feb. 11, 2026

US Stock Returns vs Global Peers, by Administration

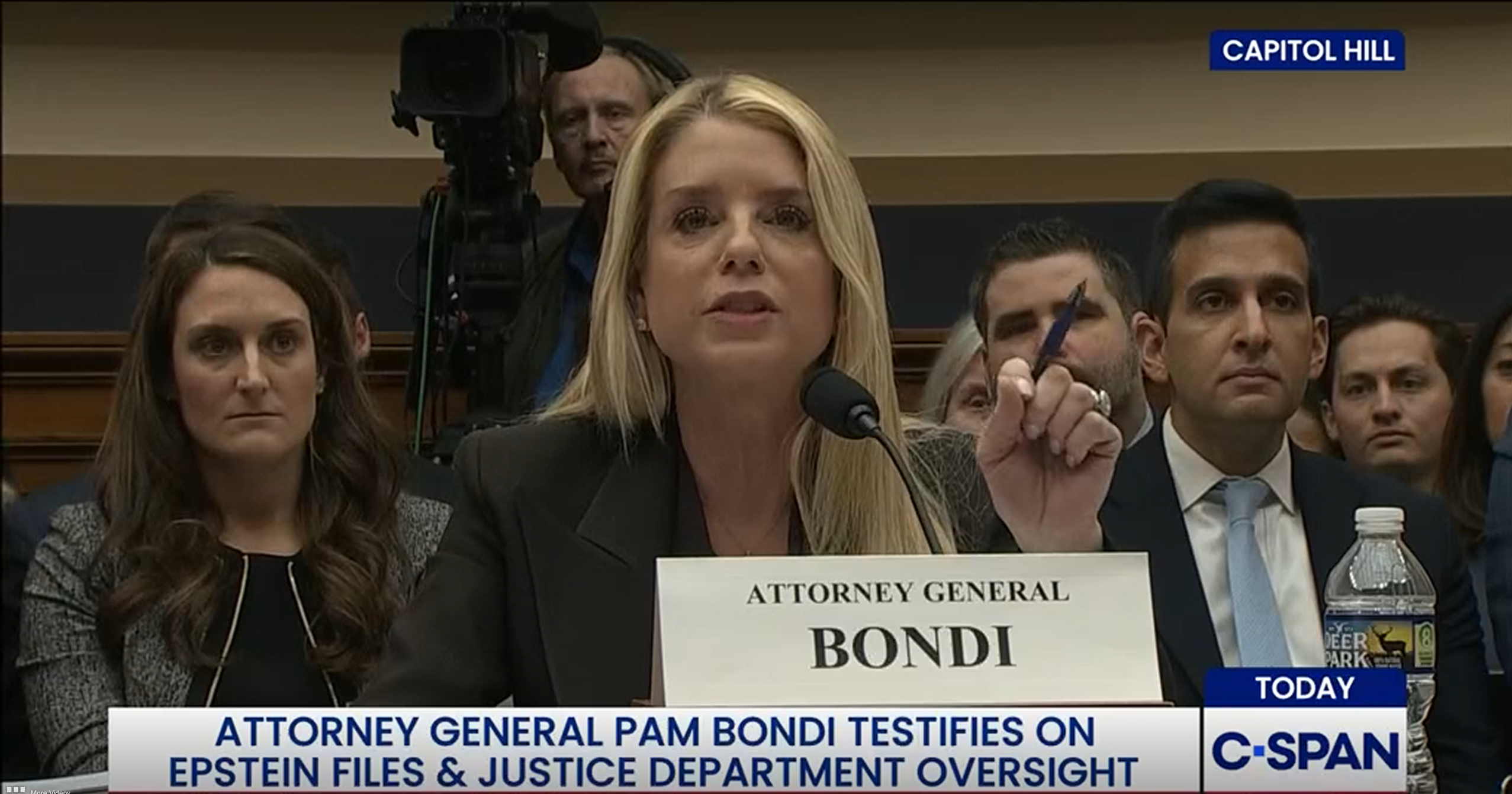

Politicians from both parties use stock charts as evidence that their administration is “working” (Pam Bondi, House Judiciary hearing, Feb. 11, 2026; President Trump remarks on Dow 30,000, Nov. 24, 2020; Biden campaign post on record highs, Dec. 15, 2023). If that’s the claim, this page measures it directly: US returns versus global peers, on aligned trading days, with one method applied to every administration.

The key question is not “did US stocks go up?” They usually do. The useful question is whether they beat the rest of the world over the same window.

Loading market data...

What this analysis does and doesn’t show

It compares US stocks against global peers, not against zero. Raw gains happened in every recent administration window. The excess return chart asks the harder question: did the US beat peers over the same dates?

Raw gains can mask relative underperformance. A market can hit record highs while still trailing peers over the same window. “Stocks are up” and “stocks are underperforming the rest of the world” can both be true simultaneously. The excess return chart captures this distinction.

US outperformance partly reflects sector composition. The US is tech-heavy (NASDAQ ~50% tech; S&P 500 ~30%), while peer markets have different sector weights. So part of any gap is structural market mix, not administration-specific effects. Switching among NASDAQ, S&P 500, and Dow Jones tests whether the sign survives that composition shift.

The Dow Jones is a narrow, price-weighted index. It contains only 30 blue-chip stocks, weighted by share price rather than market capitalization. This makes it more sensitive to individual stock moves and less representative of the broad US market than the S&P 500 (~500 stocks) or NASDAQ Composite (~3,000 stocks). The S&P 500 and NASDAQ toggles provide broader-market cross-checks.

All indices are measured in local currencies. NASDAQ/S&P are USD; KOSPI is KRW; FTSE is GBP; and so on. Exchange-rate moves are therefore embedded in the comparison. A stronger dollar can mechanically change relative results versus a common-currency setup. The VXUS toggle (USD-denominated) is a partial cross-check.

It partially controls for shared global shocks. If global markets fall or rise together, that shared move appears in both lines. Subtracting peers from US helps isolate relative performance.

It uses the same formula for every administration. Obama 2, Trump 1, Biden, and Trump 2 all use the same alignment rule, the same peer benchmark options, and the same excess-return math.

Early readings are noisy. In the first weeks, small daily moves can create big-looking excess returns that later fade. Same-day alignment helps, but short windows are unstable. Longer windows are more informative.

It tests its own robustness. The panel checks whether the sign (outperform/underperform) holds across all three US indices (NASDAQ, S&P 500, Dow Jones) and both benchmarks (custom basket, VXUS). If the sign flips, treat the result as unstable.

The custom basket is equal-weighted by design. KOSPI, FTSE, Nikkei, and DAX each get 25%, regardless of market cap. That avoids one large market dominating the benchmark. It is a choice, not a universal default; VXUS gives a cap-weighted alternative.

It does not predict markets. The projection chart is a trend extrapolation (“what if prior growth continued”), not a forecast.

It does not attribute outcomes to policy. The Federal Reserve sets monetary policy independently of the White House, and rates are a major equity driver. Global capital flows, sector rotation, dollar strength, supply chains, and sentiment also move prices outside presidential control. Even fiscal policy transmits with lags. This is an outcome comparison across administration windows, not a causal attribution model.

Methodology

Approach: Event-study excess return / relative performance measurement. The US index (NASDAQ, S&P 500, or Dow Jones) is compared against international benchmarks on aligned trading days. This implementation follows standard event-study style excess-return construction (Kothari & Warner, 2007) and the broader tradition of comparing market outcomes across administrations (Santa-Clara & Valkanov, 2003).

Conceptual note: DiD and synthetic-control literature informs the framing (Angrist & Pischke, 2009; Abadie et al., 2010), but this project does not claim a formal DiD or synthetic-control implementation. Why not formal here: there are only four administration windows, and this version does not run donor-weight optimization or formal parallel-trends tests.

Data source: Daily adjusted close prices from Yahoo Finance: NASDAQ Composite (^IXIC), S&P 500 (^GSPC), Dow Jones Industrial Average (^DJI), KOSPI (^KS11), FTSE 100 (^FTSE), Nikkei 225 (^N225), DAX Kursindex (^GDAXIP), and VXUS (Vanguard Total International Stock ETF).

Scope note: The analysis window starts in January 2013 by design (Obama 2 onward). That start date is a scope choice for this project, not a data availability constraint.

Fiscal context uses FRED series FYFSGDA188S (Federal deficit/surplus as % of GDP) plus a CBO FY2025 estimate. Policy marker metadata is compiled from CBO scores, Congress.gov records, and major tariff action trackers.

Excess Return Chart (Primary Analysis)

Primary metric: US index return minus peer-benchmark return, aligned by trading day.

excess_return(d) = [US(d)/US(inaug) - 1] - avg[index(d)/index(inaug) - 1]

- Each administration is aligned by trading day (

D0,D1,D2, …) instead of calendar date. - Above zero: selected US index outperformed the selected peer benchmark.

- Below zero: selected US index underperformed the selected peer benchmark.

Peer Benchmark Options (Custom Basket vs VXUS)

Benchmark selector options:

- Custom basket (equal-weight): KOSPI, FTSE 100, Nikkei 225, DAX.

- MSCI World ex-US proxy (VXUS): cap-weighted international benchmark proxy (Vanguard Total International Stock ETF).

- Equal weighting prevents one large market from dominating the custom basket line.

Robustness Snapshot (Descriptive)

The page includes a robustness panel that summarizes:

- Current-administration excess return sign across all 6 index/benchmark pairs (NASDAQ/S&P 500/Dow Jones x custom basket/VXUS).

- Opportunity-cost sign across all supplementary baselines for the currently selected index/benchmark pair.

- It is a directional stability check, not a formal significance test.

Opportunity Cost Definition

In this project, opportunity cost is the gap between observed US index level and a supplementary counterfactual baseline:

opportunity_cost = projected_baseline - actual_us_indexopportunity_cost_pct = opportunity_cost / projected_baseline

This is a comparative accounting metric, not a policy-causation estimate.

Supplementary Projection Chart

Projection baseline options (supplementary only):

- Historical average (default): 10.5% annualized, a commonly cited long-run US equity figure (historically closer to S&P 500 returns). Applied uniformly to whichever US index is selected as a rough baseline, not a precise forecast for that specific index.

- Middle presidential term: the middle growth rate among the three prior completed terms (Obama 2nd, Trump 1st, Biden). This is a descriptive summary, not a statistically powered estimate.

- Global peers historical average (since 2013): compounds the selected peer benchmark’s long-run daily growth rate.

- Obama 2nd term rate

- Trump 1st term rate

- Biden term rate

- 10-year trend: Jan 2015 to Jan 2025.

Each line compounds a daily growth rate estimated from its baseline window.

- Confidence bands use geometric Brownian motion quantiles (Sigman, 2006):

band(n) = S0 * exp((mu - sigma^2/2)*n +/- k*sigma*sqrt(n))wherek=1(~68%) ork=2(~95%). - 1 sigma is ~68% model-implied coverage; 2 sigma is ~95%.

- The global peers line is observed-only and rescaled to the selected US index’s Jan 2025 anchor (no projection).

Fiscal Context Chart (Deficit / GDP)

Deficit context is provided as a non-causal comparison layer.

- Source: FRED

FYFSGDA188Splus a CBO FY2025 estimate. - Fiscal years run October-September.

- Straddle years (for example FY2017, FY2021) are assigned to the president in office for most of that fiscal year.

- FY2025 is shown as a CBO estimate. Final fiscal-year data is typically published around October 2026.

Policy Event Markers

The charts include optional markers for major policy actions.

- Signed legislation with CBO 10-year fiscal impact greater than $200B.

- Tariff actions affecting more than $50B in trade volume or more than 10% of imports.

Markers show enactment timing and summary only; they do not assert causal impact on market moves. Fiscal-impact numbers are estimates, not final accounting totals.

Caveats

- Correlation is not causation. Markets respond to many factors beyond any administration.

- Projections extrapolate trend assumptions; they are not forecasts.

- International indices face different local conditions (monetary policy, demographics, sector composition).

- Adjusted-close series reduce dividend-related bias for individual indices, but treatment varies: Yahoo Finance’s adjusted close for US indices (S&P 500, NASDAQ) incorporates dividend reinvestment, while price-return indices like the DAX Kursindex and Nikkei 225 do not. This gives the US side an estimated ~1-2% annualized tailwind in the comparison. VXUS (a total-return ETF) partially offsets this as a cross-check.

- DAX uses the price-only Kursindex (

^GDAXIP) for consistency with the chosen DAX benchmark series. - VXUS is an ETF proxy and includes fund-level structure effects relative to pure index series.

Methodology Changelog

2026-02-18 (v3 index expansion)

- Added Dow Jones Industrial Average (^DJI) as a third US index toggle alongside NASDAQ and S&P 500.

- Expanded robustness matrix coverage from 4 to 6 index/benchmark combinations.

- Added Dow Jones anchor/latest-date pills and international chart line support.

2026-02-18 (v2 narrative pass)

- Reordered visualization flow to lead with excess return, then raw returns.

- Added a plain-English top-line verdict for current administration performance vs peers.

- Moved projection/deficit/international views into a collapsed “Explore the data” tier.

- Replaced the standalone objections section with “What this analysis does and doesn’t show.”

2026-02-17 (v1 hardening pass)

- Added US index toggle (NASDAQ / S&P 500) for primary comparison.

- Switched market series to adjusted close and added S&P 500 dataset.

- Replaced asymmetric Biden-only supplementary baselines with symmetric per-term options.

- Added directional robustness panel (index/benchmark matrix + baseline sensitivity signs).

- Added explicit read-guide framing and tighter descriptive/non-causal language.

- Deferred formal DiD/SCM implementation; kept methodology scoped to descriptive event-study results.

References

- Kothari, S.P. & Warner, J.B. (2007). “Econometrics of Event Studies.” Handbook of Corporate Finance, vol. 1. PDF

- Santa-Clara, P. & Valkanov, R. (2003). “The Presidential Puzzle.” Journal of Finance, 58(5), 1841-1872. Paper

- Abadie, A., Diamond, A. & Hainmueller, J. (2010). “Synthetic Control Methods for Comparative Case Studies.” JASA, 105(490), 493-505. Paper

- Angrist, J.D. & Pischke, J.-S. (2009). Mostly Harmless Econometrics. Princeton. Book

- Sigman, K. (2006). “Geometric Brownian Motion.” Columbia. PDF

- Federal Reserve Bank of St. Louis (FRED). “Federal Surplus or Deficit as Percent of Gross Domestic Product (FYFSGDA188S).” Series

- Congressional Budget Office (CBO). Cost estimates for major legislation and budget effects. Browse

Contribute

This is open source. Projection logic lives in useMarketData.ts. To propose a methodology change, open a PR with a new projection function, its mathematical basis, and which weakness it addresses.